Published by Gbaf News

Posted on January 9, 2019

Global Banking and Finance Review is an online platform offering news, analysis, and opinion on the latest trends, developments, and innovations in the banking and finance industry worldwide. The platform covers a diverse range of topics, including banking, insurance, investment, wealth management, fintech, and regulatory issues. The website publishes news, press releases, opinion and advertorials on various financial organizations, products and services which are commissioned from various Companies, Organizations, PR agencies, Bloggers etc. These commissioned articles are commercial in nature. This is not to be considered as financial advice and should be considered only for information purposes. It does not reflect the views or opinion of our website and is not to be considered an endorsement or a recommendation. We cannot guarantee the accuracy or applicability of any information provided with respect to your individual or personal circumstances. Please seek Professional advice from a qualified professional before making any financial decisions. We link to various third-party websites, affiliate sales networks, and to our advertising partners websites. When you view or click on certain links available on our articles, our partners may compensate us for displaying the content to you or make a purchase or fill a form. This will not incur any additional charges to you. To make things simpler for you to identity or distinguish advertised or sponsored articles or links, you may consider all articles or links hosted on our site as a commercial article placement. We will not be responsible for any loss you may suffer as a result of any omission or inaccuracy on the website.

Published by Gbaf News

Posted on January 9, 2019

The aftermath of the 2008 financial crisis saw regulators across the globe coming up with stress testing guidelines for their respective regions.In the US, the stress testing program which is managed by the US Federal reserve initially started in 2009 as SCAP (Supervisory Capital Assessment Program) and has matured into CCAR (Comprehensive Capital Analysis and Review) expanding coverage to 38 US Banks including 5 Foreign Banks with large US operations. In the European region the stress testing guidelines are managed by the EBA (European Banking Association) and impacts close to 100+ Banks, while in the UK the stress testing guidelines come under the purview of PRA (Prudential Regulatory Authority) impacting close to 7 large UK banks.

The complexity of the stress testing program varies across regions for different regulators in terms of data requirements, modeling methodologies, regulatory scenarios, and granularity of submissions. However, aspects like Application Architecture, Governance, Model Management, Reporting and Data Management provide a great opportunity for global banks to leverage on the commonalities, which can make stress-testing compliance more efficient and work in an integrated manner across the different regions.

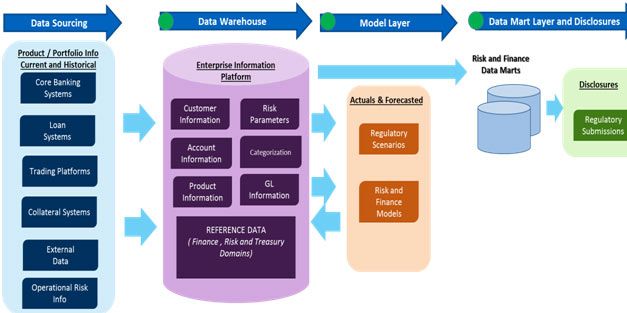

Furthermore, an integrated approach also helps global banks to reduce overall infrastructure costs and enable them to create a robust and a scalable stress-testing framework with better controls, quality and eventually enabling them to achieve better returns on their investments.Depicted in the chart below are the key components typical stress testing programs globally involve and components that can be potentially explored by global banks for achieving an Integrated Stress Testing approach.

Other components of Cross-Border Leverage

As the stress testing mandates across regions have more or less stabilized, Global Banks are looking at more and more opportunities to simplify, centralize and automate most of the processes involved in stress testing area to gain better efficiencies and controls. An integrated approach or framework could enable global banks to bring in greater efficiency in terms of cost and time to market but also bring in greater depth and consistency in their risk management and capital planning processes

About the Authors

Ajay Katara

Ajay Katara is a Domain Consultant with the Risk Management practice of the Banking and Financial Services (BFS) business unit at Tata Consultancy Services (TCS). He currently leads the BFS Risk Practice’s portfolio on Regulations and Robotics Process Automation. He has extensive experience of more than 13 years in Consulting & Solution design space cutting across CCAR Consulting, AML, Basel II implementation, and credit risk, and has worked with several financial enterprises across geographies. He has significantly contributed to the conceptualization of strategic offerings in the risk management space and has been instrumental in successfully driving various consulting engagements. He has also authored many editorials, details of which can be found in his linked in profile (https://www.linkedin.com/in/ajaykatara/)

Manoj Reddy

Manoj Reddy is the Head of BFS Risk & Compliance Practice for TCS North America with an experience of more than 15 years in the areas of financial services, IT, and business consulting. Reddy has lead several risk consulting and implementation engagements for financial firms globally. He has provided both Regulatory and Strategic Business solution to his customers over the last decade primarily in the area of CCAR, Basel, Liquidity Risk, and Enterprise Risk management and is currently leading TCS efforts in North America with respect to providing cognitive solutions for Risk & Regulatory problems.