Published by

Posted on June 12, 2023

Global Banking and Finance Review is an online platform offering news, analysis, and opinion on the latest trends, developments, and innovations in the banking and finance industry worldwide. The platform covers a diverse range of topics, including banking, insurance, investment, wealth management, fintech, and regulatory issues. The website publishes news, press releases, opinion and advertorials on various financial organizations, products and services which are commissioned from various Companies, Organizations, PR agencies, Bloggers etc. These commissioned articles are commercial in nature. This is not to be considered as financial advice and should be considered only for information purposes. It does not reflect the views or opinion of our website and is not to be considered an endorsement or a recommendation. We cannot guarantee the accuracy or applicability of any information provided with respect to your individual or personal circumstances. Please seek Professional advice from a qualified professional before making any financial decisions. We link to various third-party websites, affiliate sales networks, and to our advertising partners websites. When you view or click on certain links available on our articles, our partners may compensate us for displaying the content to you or make a purchase or fill a form. This will not incur any additional charges to you. To make things simpler for you to identity or distinguish advertised or sponsored articles or links, you may consider all articles or links hosted on our site as a commercial article placement. We will not be responsible for any loss you may suffer as a result of any omission or inaccuracy on the website.

Published by

Posted on June 12, 2023

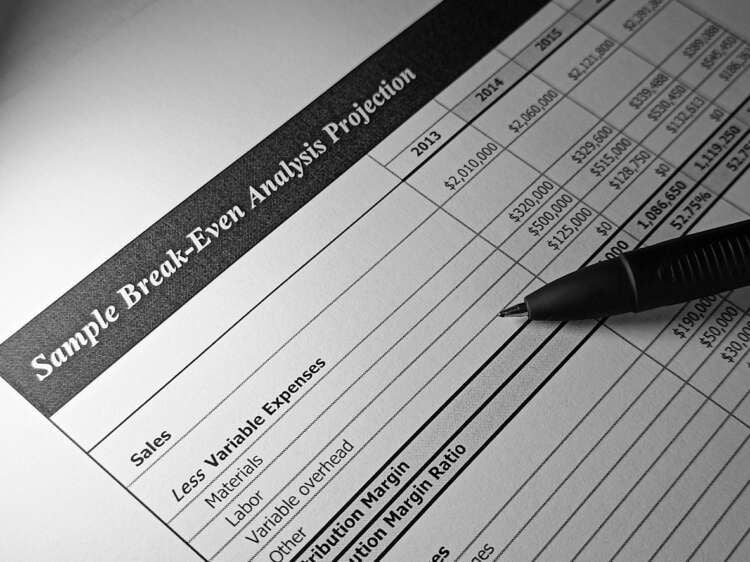

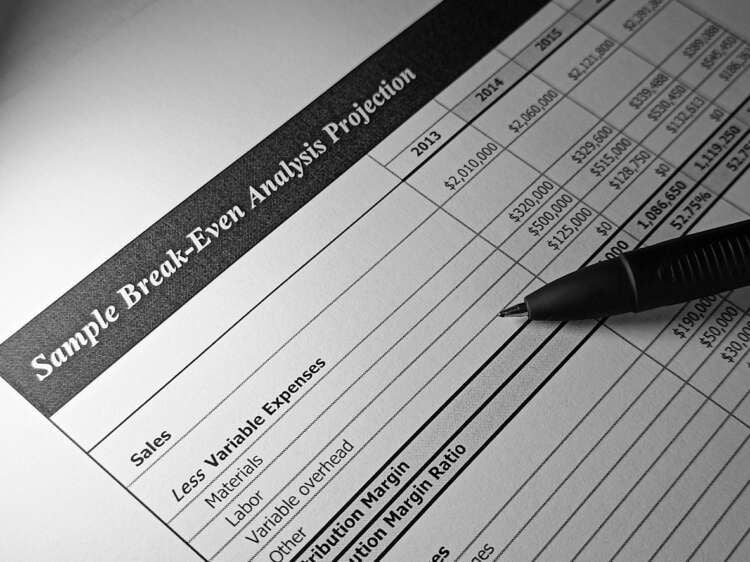

Break-Even Analysis is a powerful financial tool that helps businesses determine the point at which they neither make a profit nor incur a loss. It provides insights into the minimum level of sales or revenue required for a business to cover all its costs and expenses. In this article, we will explore how Break-Even Analysis works, its implications for businesses, and how to calculate the break-even point. We will also discuss the importance of Break-Even Analysis and its various applications in different industries.

Break-Even Analysis involves analyzing the relationship between a company’s fixed costs, variable costs, sales volume, and revenue to determine the point at which total costs equal total revenue. At this break-even point, a business is not making any profit or loss. Beyond the break-even point, every additional sale contributes to the company’s profit.

To perform a Break-Even Analysis, businesses need to identify and categorize their costs into fixed costs and variable costs. Fixed costs are expenses that remain constant regardless of the sales volume, such as rent, salaries, and insurance. Variable costs, on the other hand, fluctuate in direct proportion to the sales volume, such as raw materials and direct labor.

The break-even point is calculated by dividing the fixed costs by the contribution margin, which is the difference between the sales price per unit and the variable cost per unit. The result represents the number of units or sales volume required to cover all costs and achieve the break-even point.

Yes, the break-even point indicates the point of zero loss or profit. It represents the sales volume or revenue level at which a business covers all its costs but does not generate any profit. Below the break-even point, the business incurs losses, while above the break-even point, the business starts making a profit.

Break-Even Analysis identifies the point at which a business covers all its costs without making a profit or incurring a loss. It provides valuable insights into the minimum sales volume or revenue required to sustain the business operations and achieve financial equilibrium. Additionally, Break-Even Analysis helps businesses evaluate the impact of changes in sales volume, pricing, costs, and other factors on their profitability.

If the break-even point is zero, it means that the business does not have any fixed costs. In this scenario, the variable costs alone account for the total costs, and the business achieves the break-even point when its total revenue equals its total variable costs. This situation typically occurs in businesses with minimal fixed expenses, such as online businesses or freelancers operating from home. However, it’s important to note that even in such cases, the break-even analysis remains relevant for understanding the relationship between costs, sales volume, and revenue.

To calculate the break-even point from a profit and loss statement, businesses need to gather relevant financial information and follow these steps:

Break-Even Point (in units) = Fixed Costs / Contribution Margin

Alternatively, if you want to calculate the break-even point in terms of revenue instead of units, you can multiply the break-even point in units by the sales price per unit.

Break-Even Analysis holds significant importance for businesses due to the following reasons:

Break-Even Analysis is utilized by various stakeholders within and outside the organization, including:

While Break-Even Analysis is a valuable tool for businesses, it is important to be aware of its limitations. Understanding these limitations helps to make informed decisions and use Break-Even Analysis effectively. Here are some of the limitations:

Despite these limitations, Break-Even Analysis remains a valuable tool for businesses to understand cost structures, evaluate profitability, and make informed decisions. It provides a starting point for financial analysis and planning, but it should be complemented with other financial tools and considerations to gain a comprehensive understanding of the business’s financial performance and prospects.

Break-Even Analysis is an essential financial tool that allows businesses to determine the point at which they neither make a profit nor incur a loss. By analyzing the relationship between fixed costs, variable costs, sales volume, and revenue, businesses can identify the break-even point and gain insights into their financial stability, profitability, and cost structure. Break-Even Analysis plays a vital role in decision-making, cost control, and performance evaluation for businesses across industries, providing a foundation for sustainable growth and success.