Published by Gbaf News

Posted on November 1, 2012

Global Banking and Finance Review is an online platform offering news, analysis, and opinion on the latest trends, developments, and innovations in the banking and finance industry worldwide. The platform covers a diverse range of topics, including banking, insurance, investment, wealth management, fintech, and regulatory issues. The website publishes news, press releases, opinion and advertorials on various financial organizations, products and services which are commissioned from various Companies, Organizations, PR agencies, Bloggers etc. These commissioned articles are commercial in nature. This is not to be considered as financial advice and should be considered only for information purposes. It does not reflect the views or opinion of our website and is not to be considered an endorsement or a recommendation. We cannot guarantee the accuracy or applicability of any information provided with respect to your individual or personal circumstances. Please seek Professional advice from a qualified professional before making any financial decisions. We link to various third-party websites, affiliate sales networks, and to our advertising partners websites. When you view or click on certain links available on our articles, our partners may compensate us for displaying the content to you or make a purchase or fill a form. This will not incur any additional charges to you. To make things simpler for you to identity or distinguish advertised or sponsored articles or links, you may consider all articles or links hosted on our site as a commercial article placement. We will not be responsible for any loss you may suffer as a result of any omission or inaccuracy on the website.

Published by Gbaf News

Posted on November 1, 2012

Focusing the portfolio of expertise

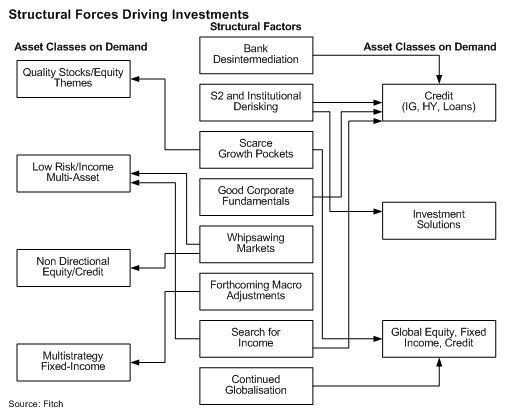

To be successful, investment strategies where demand is anticipated and where the manager is credible, will require strengthened resources (front office, commercial, product specialists, staff with international profiles); increased critical mass (by merging funds, using master feeders, moving client money); heightened commercial efforts (referencing, distribution, communication, ratings); and adoption of international standards (funds’ benchmark, product name and domicile).

Conversely, investment strategies where demand is expected to be weak and/or the manager lacks credibility will need to be scaled down, either by closing funds, outsourcing management or by using funds of funds or funds of mandates.

Expanding selectively

In order to remain competitive, asset managers in our view should not hesitate to expand into “neighbouring” activities, despite the resource and process adjustment this requires. For example, a high yield manager may consider expanding into loans, or a loan manager into high yield, as the issuer pool is similar.

Likewise, moving into the diversified income space is a logical progression for a European equity manager, given the overlap between large-cap stocks and investment-grade credit issuers. Such a development would require the recruitment of bond portfolio managers and the set-up of a top down allocation process. Long only stock and bond pickers are also well placed to navigate sideways markets by developing absolute return offerings.

Investing on long-term trends

Bank deleveraging and globalisation should also benefit the European asset management industry. The European banks’ deleveraging process is expected to generate market financing needs representing roughly 10% to 20% of the current European investor asset base (pension funds, insurance companies, mutual funds), New areas of growth fuelled by these factors include: global equity or bond products; emerging markets; senior secured high yield; direct lending; and real assets. Many of these are new to asset managers, who must develop scale and credibility if they wish to successfully compete in these areas. Yet in most cases, doing so demands serious investment in terms of local analysts, sourcing channels, and technical and legal knowledge. Fitch believes that acquisition and team lift out are the only viable options.

However, developing new activities, for example in global equity or senior secured high yield, requires significant investments in terms of personnel and/or acquisitions. Managers unwilling or unable to commit in these areas now may find themselves less able to compete in the near future.