Published by Gbaf News

Posted on May 20, 2014

Global Banking and Finance Review is an online platform offering news, analysis, and opinion on the latest trends, developments, and innovations in the banking and finance industry worldwide. The platform covers a diverse range of topics, including banking, insurance, investment, wealth management, fintech, and regulatory issues. The website publishes news, press releases, opinion and advertorials on various financial organizations, products and services which are commissioned from various Companies, Organizations, PR agencies, Bloggers etc. These commissioned articles are commercial in nature. This is not to be considered as financial advice and should be considered only for information purposes. It does not reflect the views or opinion of our website and is not to be considered an endorsement or a recommendation. We cannot guarantee the accuracy or applicability of any information provided with respect to your individual or personal circumstances. Please seek Professional advice from a qualified professional before making any financial decisions. We link to various third-party websites, affiliate sales networks, and to our advertising partners websites. When you view or click on certain links available on our articles, our partners may compensate us for displaying the content to you or make a purchase or fill a form. This will not incur any additional charges to you. To make things simpler for you to identity or distinguish advertised or sponsored articles or links, you may consider all articles or links hosted on our site as a commercial article placement. We will not be responsible for any loss you may suffer as a result of any omission or inaccuracy on the website.

Published by Gbaf News

Posted on May 20, 2014

by Brad Zaytsoff

Have you been to a conference recently where they had a session on Big Data?

Have you watched a webinar or downloaded a whitepaper about unlocking your Big Data?

Are you looking for a little less talk about why you need Big Data, and a little more information on HOW you can derive actionable intelligence from it?

Good—because in this week’s post you’ll learn how you can easily access your ATM Big Data, and how it can provide actionable intelligence to lower operational costs, generate more revenue, and improve customer experience.

If you are in retail banking it is likely that you are investing in more sophisticated, interactive ATMs to handle a greater number of transactions traditionally carried out by costly tellers (mortgage applications, account balance inquiries, check deposits…). These expanding services and the growing number of customers choosing self-service options are resulting in an explosion of (big) data available from your ATM network. The key is finding a cost effective way to access this data, a method that doesn’t require you to assemble a war room of specialists and data extraction tools before you are able to generate actionable intelligence.

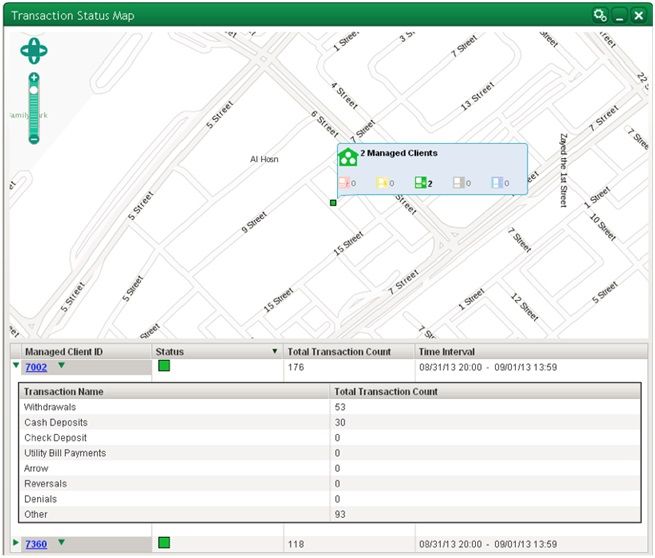

Fortunately, a real-time transaction monitoring and analytics solution can help retail banks and credit unions easily access and process ATM transactional data so they can make better and more timely decisions. This type of banking software platform captures the Big Data flowing across your ATM networks and provides a centralized deposit of rich transaction information. Its analytics engine enables you to produce customized statistics and key performance indicators—actionable operational and business intelligence that allows you to:

Better serve your ATM customer:

Reduce ATM support costs:

Improve ATM channel profitability:

Transaction monitoring and analytics solutions provide access to a wide range of customized ATM service and cash management statistics to help retail banks manage targeted campaign performance, enhance the profitability of their ATM channel, and ensure important customer interactions are secure and reliable. ATM channel managers and marketing teams will learn to love Big Data as it helps them make better business decisions regarding ATM locations, service offerings and card bases. Operations teams will be able to produce a wider array of customized alerts and performance statistics that lead to improved service availability and reduced support costs. Granular usage information such as which transactions were more common at a particular ATM, how much service revenue was produced, how many banking transactions were successful, or how many were unsuccessful provide a centralized easy way to listen to how your ATM network is performing.

Transaction monitoring and analytics solutions provide access to a wide range of customized ATM service and cash management statistics to help retail banks manage targeted campaign performance, enhance the profitability of their ATM channel, and ensure important customer interactions are secure and reliable. ATM channel managers and marketing teams will learn to love Big Data as it helps them make better business decisions regarding ATM locations, service offerings and card bases. Operations teams will be able to produce a wider array of customized alerts and performance statistics that lead to improved service availability and reduced support costs. Granular usage information such as which transactions were more common at a particular ATM, how much service revenue was produced, how many banking transactions were successful, or how many were unsuccessful provide a centralized easy way to listen to how your ATM network is performing.

For more information on how you can generate actionable intelligence and learn to love your ATM Big Data, download this complimentary whitepaper