Published by Gbaf News

Posted on January 4, 2013

Global Banking and Finance Review is an online platform offering news, analysis, and opinion on the latest trends, developments, and innovations in the banking and finance industry worldwide. The platform covers a diverse range of topics, including banking, insurance, investment, wealth management, fintech, and regulatory issues. The website publishes news, press releases, opinion and advertorials on various financial organizations, products and services which are commissioned from various Companies, Organizations, PR agencies, Bloggers etc. These commissioned articles are commercial in nature. This is not to be considered as financial advice and should be considered only for information purposes. It does not reflect the views or opinion of our website and is not to be considered an endorsement or a recommendation. We cannot guarantee the accuracy or applicability of any information provided with respect to your individual or personal circumstances. Please seek Professional advice from a qualified professional before making any financial decisions. We link to various third-party websites, affiliate sales networks, and to our advertising partners websites. When you view or click on certain links available on our articles, our partners may compensate us for displaying the content to you or make a purchase or fill a form. This will not incur any additional charges to you. To make things simpler for you to identity or distinguish advertised or sponsored articles or links, you may consider all articles or links hosted on our site as a commercial article placement. We will not be responsible for any loss you may suffer as a result of any omission or inaccuracy on the website.

Published by Gbaf News

Posted on January 4, 2013

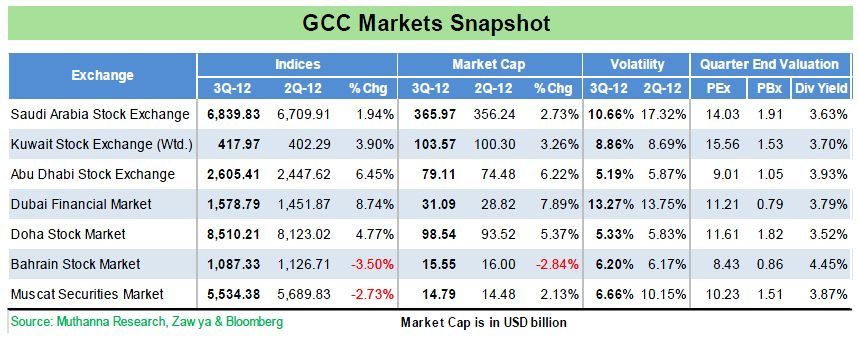

uncertainty in oil markets, which in turn affected sentiment; particularly in the banking and petrochemical sector. The falling spree-post September 15, gained a further pace by the month end and the market lost 326 points (4.56%) within last two weeks of the month. Saying so, by 3Q end, TASI managed to save some of its earlier gains and ended the period with a 1.94% (129.92 points) gain only. In totality, Year 2012 is witnessing a sort of alternate session of peak and trough as in 1Q, it added 22.09% but lost 14.36% in 2Q. The index touched its quarter-peak on September 01, to reach 7,179.49 and touched its low on July 18, at 6,555.91, reflecting a range bound of 623 in the quarter, which is clearly reflected in its double digit volatility. On the country news side, government has drawn mega plans across the board for the public welfare. The Kingdom has approved USD 72 billion worth of infrastructure projects in Year 2012 and see no full stop. In the Healthcare, Saudi Arabia plans to open 132 new hospitals – adding 26,700 beds to its current healthcare landscape, in next two years. On the construction side, the list is too long in terms of water, residential, solar and roads construction projects, especially for 3 big cities of Mecca, Riyadh and Jeddah. In a nutshell, despite of IMF projecting a small deficit by 2017 and growing affiliation of the Saudi market to Global downfall and slowdown, we believe the long term story for the country remains intact given the emerging role of private industry as well as improving job scenarios, living standard and controlled inflation.

uncertainty in oil markets, which in turn affected sentiment; particularly in the banking and petrochemical sector. The falling spree-post September 15, gained a further pace by the month end and the market lost 326 points (4.56%) within last two weeks of the month. Saying so, by 3Q end, TASI managed to save some of its earlier gains and ended the period with a 1.94% (129.92 points) gain only. In totality, Year 2012 is witnessing a sort of alternate session of peak and trough as in 1Q, it added 22.09% but lost 14.36% in 2Q. The index touched its quarter-peak on September 01, to reach 7,179.49 and touched its low on July 18, at 6,555.91, reflecting a range bound of 623 in the quarter, which is clearly reflected in its double digit volatility. On the country news side, government has drawn mega plans across the board for the public welfare. The Kingdom has approved USD 72 billion worth of infrastructure projects in Year 2012 and see no full stop. In the Healthcare, Saudi Arabia plans to open 132 new hospitals – adding 26,700 beds to its current healthcare landscape, in next two years. On the construction side, the list is too long in terms of water, residential, solar and roads construction projects, especially for 3 big cities of Mecca, Riyadh and Jeddah. In a nutshell, despite of IMF projecting a small deficit by 2017 and growing affiliation of the Saudi market to Global downfall and slowdown, we believe the long term story for the country remains intact given the emerging role of private industry as well as improving job scenarios, living standard and controlled inflation.

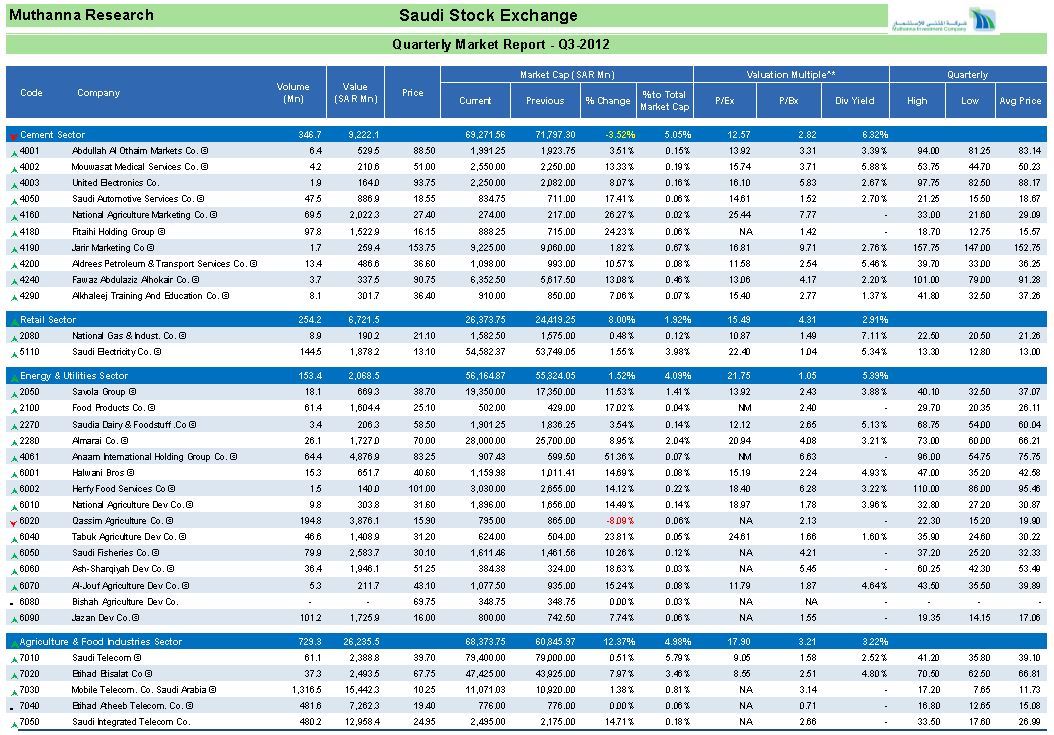

b. The benchmark witnessed one new listing; Catering in the Agriculture & Food Industries on July 09, 2012, thus taking total tally to 156.

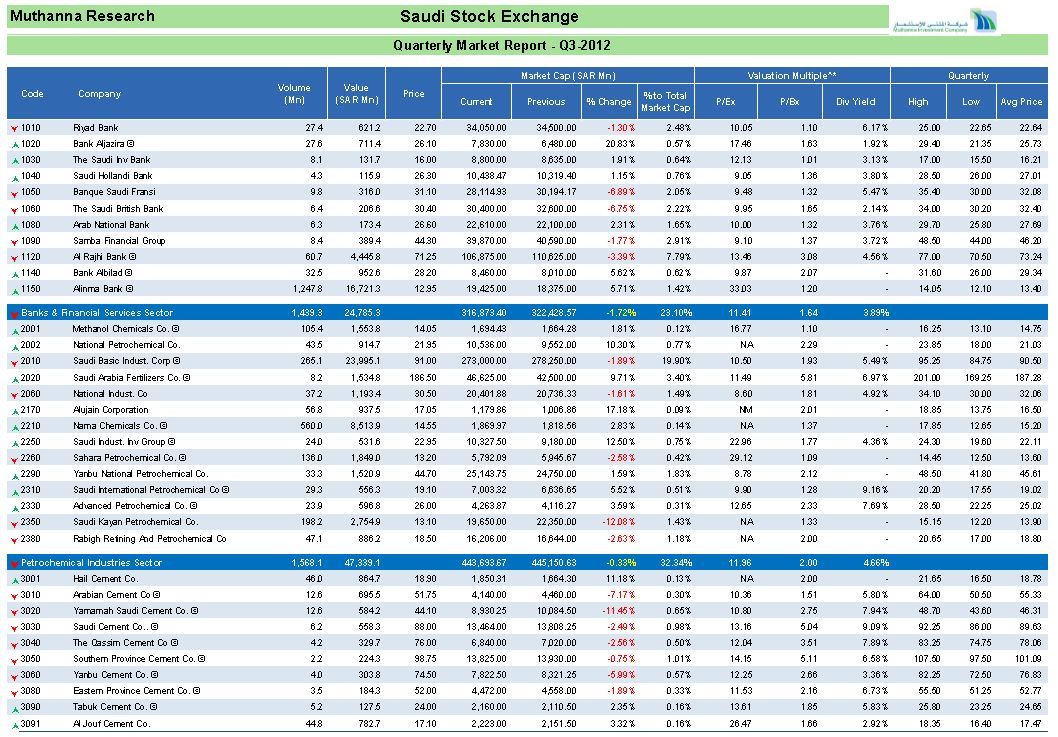

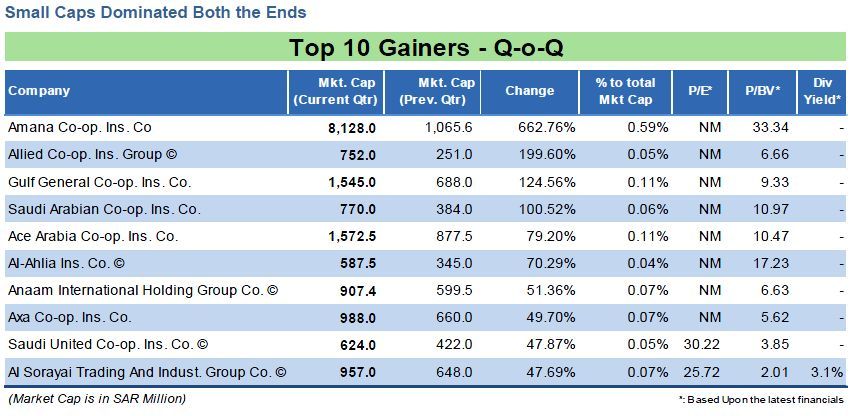

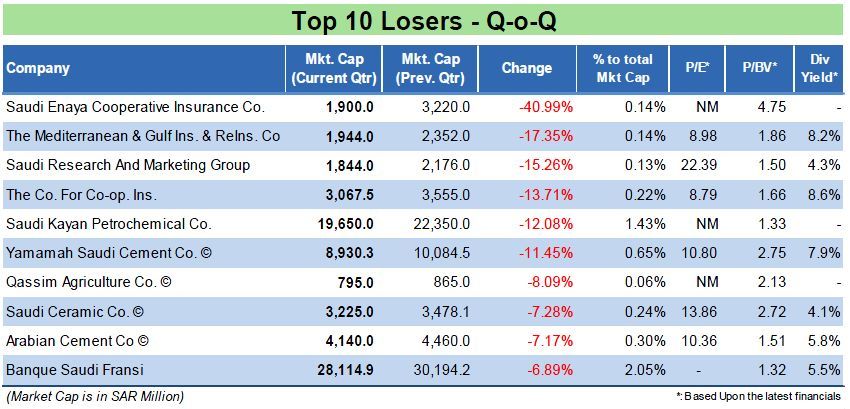

c. On the Sector Indices front, the Cement was the worst performer, as it lost 4% on the Index front as well as 0.8% on the market capitalization front. Out of 10 listed stocks, 7 witnessed a quick erosion in their market cap, especially sector’s bellwethers like Southern Province (sharing 21% of sector market cap), Saudi Cement (sharing 20.5% of sector market cap) and Yamamah Cement (sharing 13.6% of sector market cap) lost 0.75%, 2.49% and 11.45% respectively. Hail cement was the only double digit gainers for the month as it added 11.18% in the market cap. During the quarter, Southern Province announced about the delay of the operation of the third mill in Jazan Plant, which dragged down the price level.

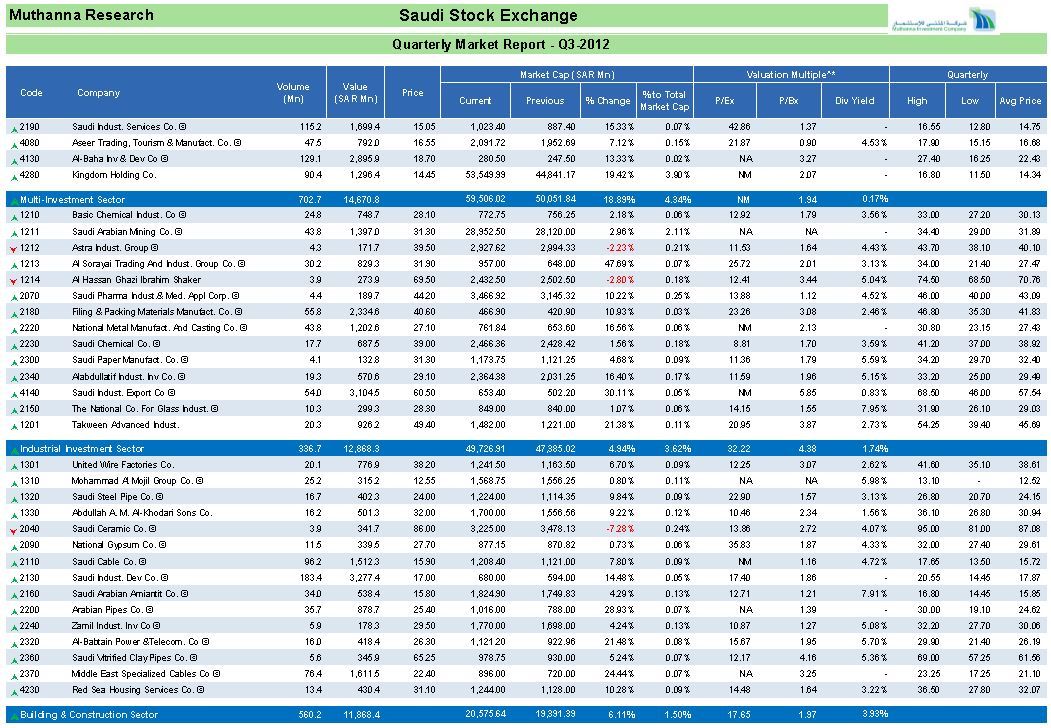

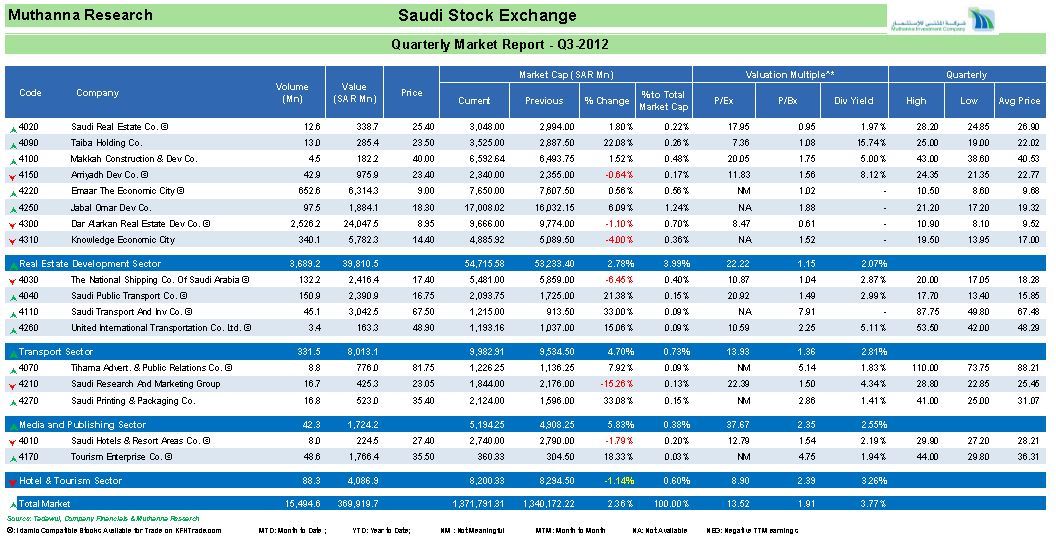

d. On the market capitalization side, the market cap mirrored the overall index performance; as out of 15, baring 3 namely – the Cement, Petrochemical and Banks 12 sectors added value in their market cap in a range of 1.5% to 43.9%. The Petrochemical sector remained an exception as it grew by 0.2% on Index level but contracted by 0.3% on the market cap side. Such odd behavior is mainly due to fall in SABIC and Saudi Kayan which reported a dip of 1.89% and 12.08% q-o-q basis. Overall market capitalization soared to SAR 1.371 trillion, from SAR 1.337 trillion a quarter ago. 3 major sectors namely, Banks & Financial Services, Petrochemical and Telecommunication continued to account for 66% of total market capitalization. Lower than 68% a quarter ago.

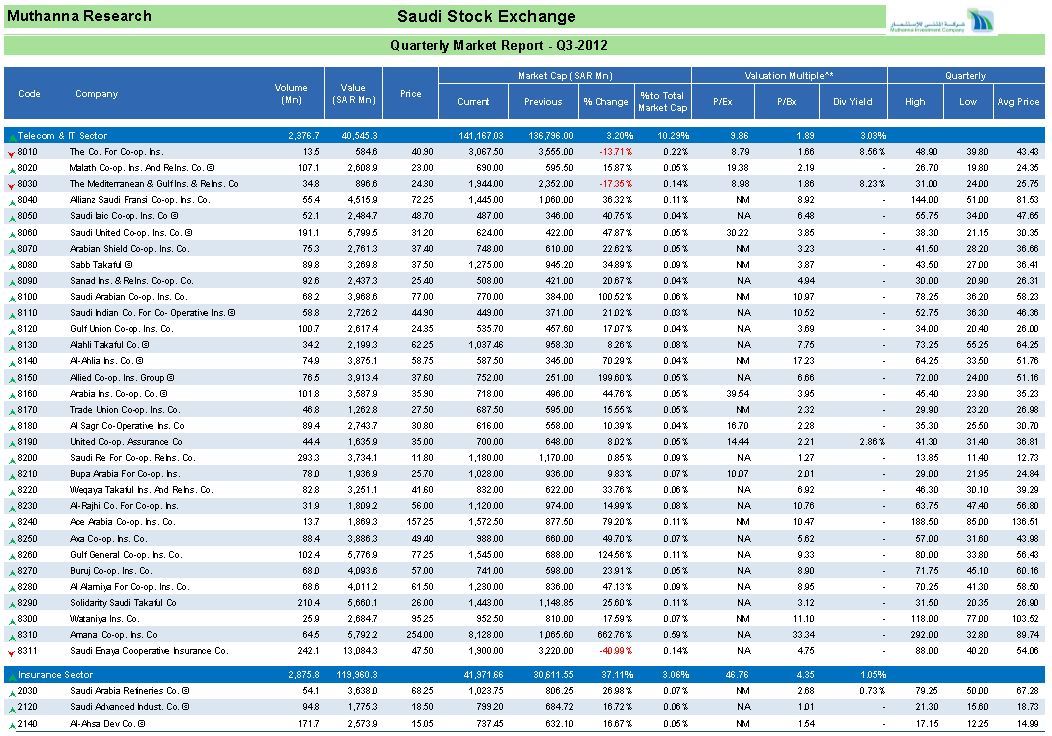

e. The Insurance sector remained the best performer on both the fronts; as it surged 35% on Index level while added 44% on the market cap corner. Amana Co-Operative reported a whopping gain of 662.76% in the quarter while Allied Co-Operative Insurance almost tripled its market cap in the period. In addition, Gulf General and Saudi Arabian Co-Ops Insurance inflated by 124% and 100% respectively, thus provided a booming impetus to Insurance.

f. Following the Insurance, Multi-Investment sector remained another outperformer in the period, gaining 19% in its market cap, mainly due to robust performance of its bellwether Kingdom Holding Co. which added SAR 8.71 trillion alone (19.42%) in the total sector addition of SAR 9.46 trillion.

g. Out of 156 stocks, as of October 11, 39 stocks announced their 3Q earnings. As per Gulfbase, total market earnings (announced so far) reached SAR 25.28 billion, up by 2.55 from a year ago. The improvement in earnings is a clear proof that market remained a lead indicator of better sentiments in the course.

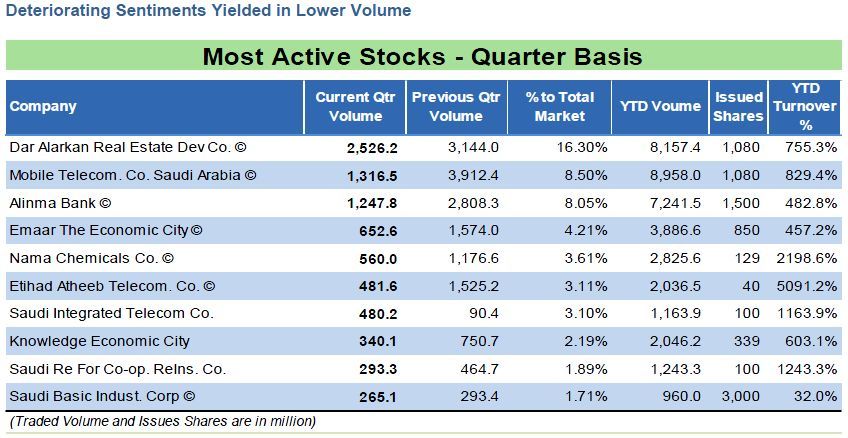

b. Dar Alarkan Real Estate Dev Co was the most active stock as it reported a jump of 9.2% in its 6M-2012 net income, which was welcomed by investors. In other development, the company disclosed that it had fully repaid USD 1 billion Sukuk- due in July. These two news acted as catalyst for the company’s market cap, which saw a run of 23.5% during the quarter.

c. Mobile Telecommunications Co – Zain KSA followed Dar Al Arkan post the capital restructuring during the quarter. The mobile operator increased its capital through a rights issue to dilute its accumulated losses as well as to ease the “debt to equity” stretching ratio.

Prepared by:

Shoyeb Ali, Vice President, [email protected]